Contents

If you are https://forex-trend.net/ly using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. It is recommended that you upgrade to the most recent browser version. On the publication date, Faizan Farooque did not have any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to theInvestorPlace.comPublishing Guidelines. Positive influence on the financial decisions of the teachers who used the program with their students.

The bottom row provides options for routing the order which are not important for this piece. Fidelity and TD Ameritrade are two providers, though there are many more. Accounts are usually free and even trading stocks is free with the majority of brokerages. People often use the terms Bear Market or Bull Market to describe the current state of the stock market.

But your support is essential to keeping Steve on the beat, covering the costs of reporting our stories. You provide the motivation and financial support to keep doing what we do. Interesting Facts About How the Stock Market WorksThe first company traded on the New York Stock Exchange was the Bank of New York. I have looked at your portfolio, and have some initial observations. These are not specific recommendations, but rather investment issues to think about, based on your specific situation. Google Translate cannot translate all types of documents, and it may not give you an exact translation all the time.

A Deeper Look at How the Stock Market Works

At the beginning of 2002, Peter received another $2,000. He waited and https://en.forexbrokerslist.site/ed the money on October 9, 2002, the lowest closing level for the market for that year. He continued to time his investments perfectly every year through 2020. Long-term investments are more likely to yield higher gains. While risky, stock investing can be a powerful way to grow your assets and increase your wealth over time.

- By accessing the How The Market Works site, you agree not to redistribute the information found within and you agree to the Privacy Policy and Terms & Conditions.

- When this happens the company must pay each individual the amount they invested.

- An investor in the Primary Market should expect to earn a reasonable return on investment by collecting dividends over the indefinite future.

- It is considered a reliable gauge of the market because it tracks the performances of the biggest corporations.

But the importance of stock markets goes beyond mere speculation. By allowing companies to sell their shares to thousands or millions of retail investors, stock markets also represent an important source of capital for public companies. Once the company’s shares are listed on a stock exchange and trading on the market, the price of these shares fluctuates as investors and traders assess and reassess their intrinsic value. There are many different ratios and metrics that can be used to value stocks, of which the single-most popular measure is probably the price-to-earnings ratio. Stock analysis tends to fall into one of two camps—fundamental analysis, or technical analysis.

The Stock Market Game™ works.

Mutual funds and ETFs allow investors to use a single purchase to invest in a pool of securities. Instead of buying individual stocks, you can buy into a wide range of holdings. Diversifying your investments is a way to mitigate risk. If all your money is in one stock, industry or sector, an unexpected market dip could tank your portfolio.

However, your money could also be cut in half if the stock market crashed. At the bank, your money is guaranteed by the government. A financial market is a place where firms and individuals enter into contracts to sell or buy a specific product such as a stock, bond, or futures contract. Buyers seek to buy at the lowest available price and sellers seek to sell at the highest available price. There are a number of different kinds of financial markets, depending on what you want to buy or sell, but all financial markets employ professional people and are regulated. Its first option is to use its profits for capital — called reinvestment.

How Does Inflation Affect the Stock Market?

In other words, if you are a Robin Hood customer, when you submit an order, these big-shot money managers see the order before the rest of the market does. This enables them to act with market momentum before the rest of the market sees it. In most cases, these gains are merely pennies per share, but when you are doing this tens of thousands of times per second across the entire market, those pennies add up very quickly. The other way big-shot money mangers and funds make money is through arbitrage.

Certificates of partial ownership in the joint stock company attested to an ownership share and could be bought and sold. Ultimately the stock certificates representing ownership in the capital stock of the joint stock company came to be referred to as simply “stocks” or “shares”. The secondary market is where investors come to buy stocks from other investors.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. If you’re tempted to try to wait for the best time to invest in the stock market, our study suggests that the benefits of doing this aren’t all that impressive—even for perfect timers.

It made lots of https://topforexnews.org/ and everyone in town loved to eat there. You had the idea to open 9 more shops around the country. With 10 total shops, you would make $800,000 a year in profit. From the information that you provided to us, I found that you want to pursue a more active investment strategy by adding stocks to your current equity portfolio in the Vanguard 500 Index Fund. So I have done some analysis on the possible combination of these stocks.

Motley Fool Returns

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Universities and top companies use HowTheMarketWorks.com for stock market training. This is a financial simulation, no real accounts are being opened, no jobs are being offered and nothing of monetary value is being exchanged or placed in any accounts. This is a financial simulation, no real accounts are being opened, jobs being offered and nothing of monetary value is being exchanged or placed in any accounts.

He had incredible skill and was able to place his $2,000 into the market every year at the lowest closing point. For example, Peter had $2,000 to invest at the start of 2001. Rather than putting it immediately into the market, he waited and invested on September 21, 2001—that year’s lowest closing level for the S&P 500.

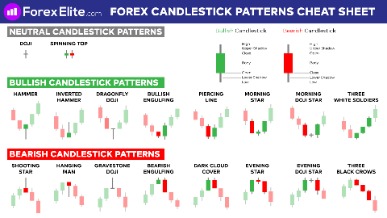

This is the type of market most investors prosper in, as the majority of stock investors are buyers, rather than short-sellers, of stocks. A bear market exists when stock prices are overall declining in price. Stock prices on exchanges are governed by supply and demand, plain and simple. At any given time, there’s a maximum price someone is willing to pay for a certain stock – the bid price – and a minimum price someone else is willing to set for the shares of stock – the ask price. Buyers are constantly bidding for the stocks that other investors are willing to sell. Individual and institutional investors come together on stock exchanges to buy and sell shares in a public market.

Investment bankers buy large quantities of the stock from the company and then resell the stock on an exchange. First, to truly explain the stock market, we have to talk about what causes the value to rise or fall. Engages students and improves academic performance, financial knowledge, and saving and investing habits. Build a fundamental understanding of investing while providing students with real-world skills and practice in math, English language arts, economics, social studies, and other subjects. An industry-wide financial education and capital markets literacy campaign convening volunteers from hundreds of financial firms. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.

Stock exchanges are marketplaces that allow you to buy and sell stocks. The New York Stock Exchange and the Nasdaq are the two dominant stock exchanges in the U.S. Every exchange has its own requirements that companies must meet to list their stock. The NYSE, for example, requires a minimum share price of $4 for an initial listing. In addition, the market value of a company’s publicly held shares must be at least $40 million, though some listings require $100 million. Also, the stock market is divided into two sections, the primary and secondary markets.